Insurance Policy Solutions Unveiled: Guard Your Future With Comprehensive Insurance Policy Providers

Are you seeking means to secure your future and make certain monetary safety and security? Look no more! Our article, "Insurance coverage Solutions Unveiled: Safeguard Your Future With Comprehensive Insurance Policy Services," will certainly lead you through the ins and outs of insurance protection. Discover the relevance of detailed plans, discover various sorts of insurance policy, and gain useful ideas for choosing the right company. Don't lose out on optimizing your insurance coverage and navigating the claims procedure easily (Liability Insurance Eden Prairie). Start protecting your future today!

The Importance of Comprehensive Insurance Protection

You need to recognize the significance of having thorough insurance coverage for your future. Life is uncertain, and you never ever understand what may happen. That's why it's essential to have comprehensive insurance policy that can safeguard you from different threats and uncertainties.

Extensive insurance protection supplies you with a vast array of security. It not only covers problems to your property yet likewise shields you economically in situation of crashes, theft, or all-natural catastrophes. With detailed insurance coverage, you can have satisfaction understanding that you are monetarily safe even in the worst-case scenarios.

Among the essential advantages of detailed insurance policy is that it covers damages to your car brought on by crashes, vandalism, or fire. Rather than fretting about the expenditures of fixing or replacing your automobile, comprehensive coverage makes sure that you are protected monetarily.

In addition, extensive insurance coverage additionally covers theft-related occurrences - Auto Insurance Eden Prairie. If your cars and truck obtains taken or any type of useful things are stolen from it, detailed protection will certainly compensate for the loss, reducing the economic problem on you

Additionally, extensive insurance coverage secures your home or residential or commercial property from damages triggered by all-natural calamities like hurricanes, floods, or quakes. This protection ensures that you can rebuild and recoup without dealing with significant financial problems.

Understanding the Different Kinds Of Insurance Policies

Understanding the various sorts of insurance coverage can aid you make notified choices regarding your insurance coverage options. There are numerous kinds of insurance plan readily available to individuals, each offering a various purpose and offering certain benefits. One common kind of insurance coverage is auto insurance coverage, which supplies coverage for injuries and problems arising from car crashes. This kind of insurance is required by regulation in a lot of states and can aid secure you economically in situation of a mishap. One more crucial sort of insurance coverage is health insurance coverage, which covers clinical expenditures and offers access to health care services. Having medical insurance can assist you manage the costs of medical treatments and make certain that you obtain essential care. Home owners insurance is one more kind of insurance policy that secures your property and personal belongings against damage or theft. It can offer financial aid in situation of fire, natural disasters, or various other covered occasions. Finally, life insurance is designed to offer financial backing to your enjoyed ones in the occasion of your fatality. Understanding these various sorts of insurance coverage can aid you select the right insurance coverage for your certain needs and secure yourself and your possessions.

When Picking an Insurance Policy Provider,## Variables to Consider.

When taking into consideration an insurance coverage service provider, it is very important to research their online reputation and customer reviews. You wish to make certain that you choose a reliable and dependable firm that will certainly be there for you when you require them the most. Beginning by seeking out on-line testimonials and scores from other insurance holders. These reviews can give you important insights right into the provider's customer support, declares procedure, and total satisfaction. In addition, check if the insurance provider has been recognized by reputable organizations or if they have actually won any type of sector honors. This can be a good indicator of their professionalism and reliability and commitment to offering their consumers. An additional variable to consider is the series of insurance products offered by the provider. You want to see to it that they supply the details insurance coverage you need, whether it's vehicle, life, wellness, or home insurance policy. Take an appearance at the provider's financial security. You wish to pick a company that has a strong financial standing and is able to accomplish their commitments in case of an insurance claim. By extensively looking into and taking into consideration these aspects, you can make an informed decision and pick the right insurance coverage service provider for your requirements.

Tips for Maximizing Your Insurance Policy Protection

One method to obtain the most out of your insurance policy protection is by regularly assessing and updating your plan. Insurance coverage needs can change over time, so it's vital to make sure that your insurance coverage aligns with your existing situation. Start by reviewing the protection limitations and deductibles on your policy.

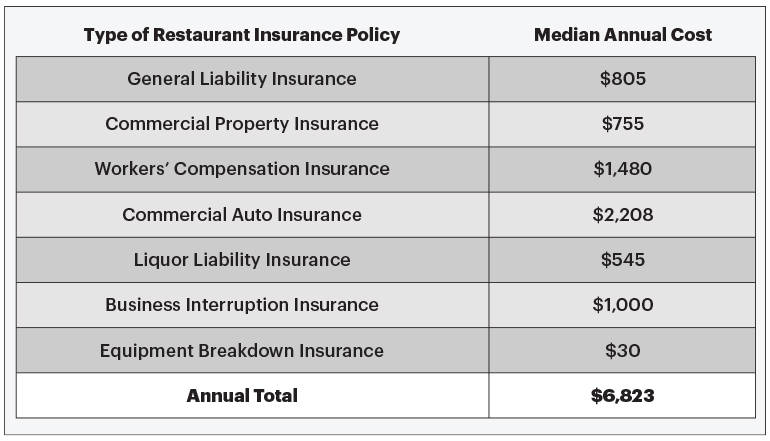

It's also important to evaluate the types of insurance coverage consisted of in your plan. If you have a company, you might this content need added insurance coverage for expert liability or cyber obligation.

Another essential element of optimizing your insurance policy coverage is understanding the exemptions and constraints of your plan. Make the effort to go through your policy files and ask your insurance coverage service provider any type of concerns you may have. Recognizing what is covered and what is not can assist you make educated choices regarding your insurance coverage.

Finally, take into consideration searching for insurance coverage quotes periodically. Insurance coverage prices can vary amongst service providers, so it deserves comparing costs to ensure you are getting the see here ideal offer for the coverage you need. Maintain in mind that the most inexpensive choice may not constantly be the very best, so think about elements such as consumer solution, claims procedure, and monetary stability when selecting an insurance policy supplier.

Navigating the Claims Process: What You Need to Know

Contact your insurance provider as soon as possible after the event takes place. Your insurance company may require you to fill out details types or give additional information. If you have any kind of inquiries or concerns along the method, don't wait to get to out to your insurance policy carrier for assistance.

Conclusion

So there you have it, a comprehensive guide to guarding your future with insurance policy options. Since you comprehend the value of thorough coverage and the different sorts of policies available, it's time to pick the ideal insurance company for you. Keep in mind to take into consideration factors like reputation, client service, and price. And as soon as you have your policy in position, do not fail to remember to maximize your coverage by reviewing it on a regular basis and making any type of essential adjustments. If you ever before require to make a case, be certain to browse the process with confidence, knowing what to expect. With the right insurance policy options, you can have peace of mind recognizing that you are safeguarded for whatever the future might hold.